How Much Does Medicare Part B Cost?

Medicare Part B: A Comprehensive Guide to Costs & Payments

Welcome to another insightful session at Medicare daily school where we delve into the nitty-gritty of Medicare intricacies to empower you with the knowledge you need. Today our puzzle piece in discussion is ‘Medicare Part B.’

We’ll unpack what it may cost you, what you’d be out of pocket in regards to Part B of Medicare, and outline critical aspects to consider. Before proceeding, it would be best to recall that Medicare Part A covers inpatient treatments, while Part B caters to outpatient services.

Itemized Healthcare Costs

In the labyrinth of healthcare costs, there are distinct items that one could be expected to pay for:

Premiums

Deductibles

Copays

Coinsurance

These are the potential out-of-pocket expenses that come with any healthcare plan.

Medicare Part B Premiums

Unlike Part A, which is usually zero premium, Medicare Part B entails a premium unless you qualify for 100% Medicaid— the joint federal and state program. Currently, the premium stands at $164.90 per month for most people. For married couples both on Medicare, you’d be multiplying that figure by two.

If you’re on Social Security, the premium will be deducted from your check. If you aren’t, you have a couple of options,

Direct billing on a quarterly basis, amounting to just over $500

Create a mymedicare.gov account to pay your bills online monthly

Set up Medicare EasyPay, a system that automatically deducts the payment from your selected bank on the 20th of every month

The principle here is that Medicare Part B is not free. The cost is primarily predicated on what is referred to as your ‘Modified Adjusted Gross Income’ (MAGI).

Understanding the MAGI

Your MAGI entails your Adjusted Gross Income (AGI) ordinarily line 11 on the 1040 form, following by added tax-exempt interest. Various items, such as tax-exempt bonds used for educational purposes, among others, qualify for this federal tax-exempt interest.

Important note:

Medicare utilizes your MAGI to determine your Part B premium every year. Still, the Interesting bit is that they ‘look back’ two years. For example, in 2023, they’ll examine your 2021 MAGI. They can’t look back just one year because tax filings aren’t due until mid-April, but it could extend to October 15th with an extension.

Now let’s delve a bit into some thresholds that might determine your MAGI:

For a single filer with a MAGI two years prior of $97,000 or less, you’ll pay $164.90.

For a married couple filing jointly, if the number is $194,000 or less, each spouse would pay the $164.90.

Beyond these figures, five different thresholds – Income Related Monthly Adjusted Amounts (IRMAAs) come into play. The extra charges range from around $80 to $440 p/m, and they’ll apply to both your Medicare Part B and Part D if you’re a high-income earner.

Copays, Deductibles & Coinsurance

For the current year, the Part B deductible stands at $226 per year. After meeting this deductible, Medicare functions as an 80-20 plan. Essentially, Medicare pays 80% of the services they cover, while you foot the remaining 20% balance. This balance, known as coinsurance, is unlimited and applies each time you seek a service.

Moreover, you may encounter an excess charge, although it’s relatively rare. This happens when a doctor who treats Medicare patients (but isn’t under a contract called assignment or participating doctor) decides to add a 15% charge above what Medicare approves.

In conclusion, key costs to bear in mind for Medicare Part B include the premium, the annual deductible, the never-ending 20% coinsurance, and possibly a 15% excess charge. By understanding these costs, you’re empowered to navigate the tricky waters of healthcare expenses effectively.

What to Expect on Your Call With a Medicare School Guide

Enroll correctly which means you will avoid penalties.

Understand your coverage so you aren't surprised by any unexpected out-of pocket expenses.

Avoid selecting a plan with limited coverage which means you can be confident in your decision.

Save time with our simplified process so you can spend more time doing what you enjoy.

Receive unbiased advice from our independent guides that work for you, not an insurance company.

We are holding appointment slots for you, answer the question below to get started

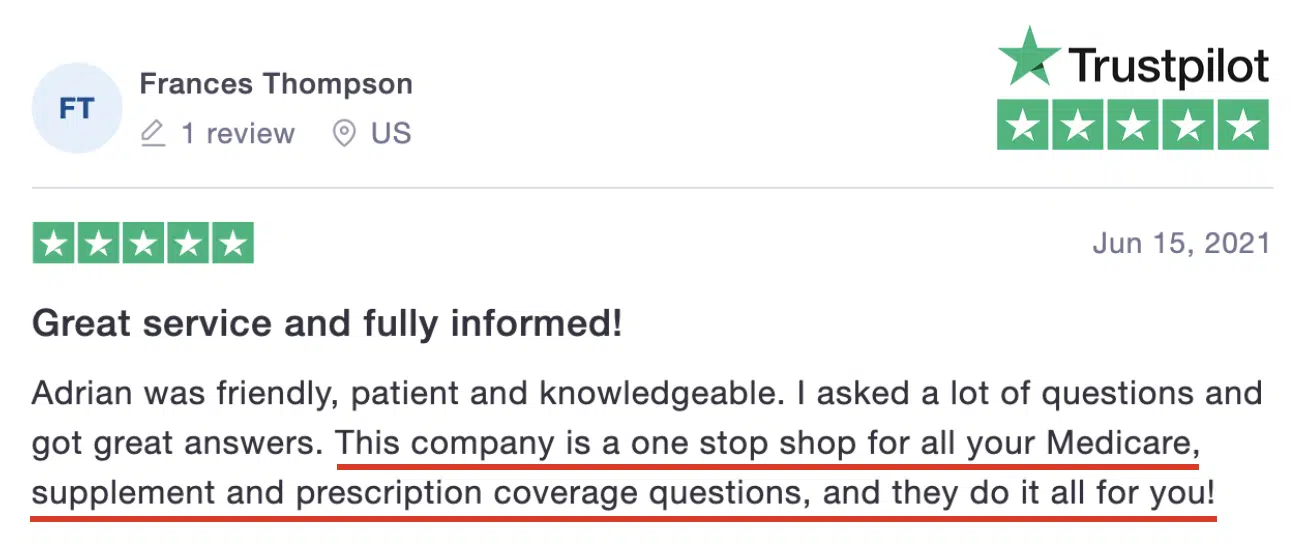

The Reviews are In!