- 10 min read

Guide to Medicare Part D: Prescription Drug Plans

Are you on Medicare and have medications you need covered? In this guide to Medicare Part D, we’ll discuss what prescription drug plans you might need.

As you reach eligibility for Medicare, managing healthcare costs becomes a top priority. Original Medicare covers a significant portion of your medical expenses, but your medications are still an out-of-pocket cost to consider, particularly when it comes to prescription drugs. This is where Medicare Part D comes in.

Medicare Part D, often called a Medicare drug plan, is a voluntary prescription drug insurance program available to all individuals enrolled in Medicare. This insurance plan helps bridge the gap in coverage for outpatient prescription medications that Original Medicare doesn’t typically cover. While not mandatory, enrolling in the right Medicare Part D plan is a good idea for most beneficiaries, offering financial protection and ensuring access to the medications you need to maintain your health and well-being.

What Does Medicare Part D Cover?

Medicare Part A and Part B only cover medications related to a covered service. In most other cases, Medicare Part D is needed to cover self-administered prescription drugs you can take at home. In some cases, it may also cover certain professionally administered medications, such as injections or infusions typically provided in an outpatient setting.

Here’s a breakdown of what Medicare Part D typically covers:

- Prescription medications for a variety of conditions

- Certain generic and brand-name drugs (depending on the plan’s formulary)

- Mail-order prescriptions to potentially reduce medication costs

Remember that Medicare Part D plans don’t cover over-the-counter medications, vitamins, or other non-prescription drugs.

Key Features of a Medicare Drug Plan

Whether you choose a standalone Medicare Prescription Drug Plan (PDP) or a Medicare Advantage Prescription Drug Plan (MAPD), key features like pharmacy networks and formularies will be consistent.

Pharmacy Networks consist of a list of pharmacies where you can fill your prescriptions. These networks typically include preferred pharmacies, which offer lower prices, and standard pharmacies. Many plans also include mail-order pharmacies for even greater cost savings on medications.

Formularies are the list of medications covered by your plan. Formularies vary in terms of the medications they cover with some covering primarily generic drugs and a few brand names. Other plans have more comprehensive formularies that cover a wider range of brand-name medications, which typically come with higher premiums.

Ready to talk to a guide?

Book a free call by clicking below or if you are free now give us a call at: 800.8648890

How Does Medicare Part D Work?

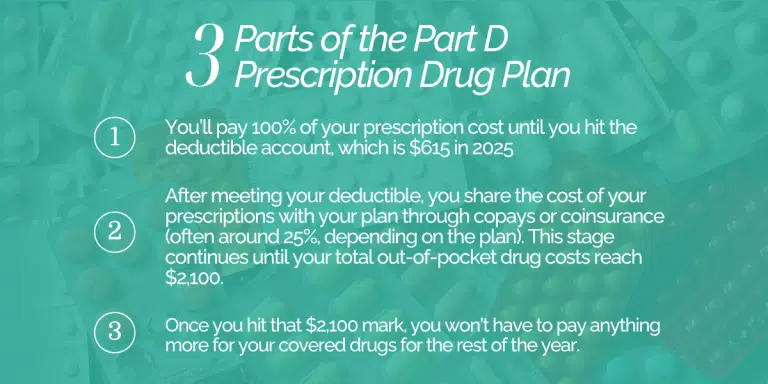

Once you enroll in a Medicare Part D plan, your coverage will follow a three-stage process due to major improvements in 2025

- Deductible: This is the initial amount you may pay out of pocket for covered medications before your plan begins sharing the cost. Deductibles vary by plan, but Medicare limits how high they can be. In 2026, no Part D plan can have a deductible higher than $615, and many plans offer lower deductibles or none at all.

- Initial Coverage: After meeting your deductible, you enter the stage where you share drug costs with your plan through copays or coinsurance. Your out-of-pocket spending for covered prescriptions is limited to $2,100 for the year. Once you reach that amount, you move to the next stage of coverage.

- Catastrophic Coverage: Once you hit the $2,100 out-of-pocket maximum, your Part D plan covers 100% of the cost of covered prescription medications for the rest of the year.

Keep in mind that your actual deductible and copays depend on the specific plan you choose. Overall, Medicare Part D coverage is designed to limit how much you spend on prescriptions each year and provide full coverage once you reach the annual out-of-pocket maximum.

What Does Medicare Part D Cost?

The cost of your Medicare Part D plan in 2026 will depend on factors such as the specific plan you choose, its coverage details, your location, and the medications you take. In addition to your monthly premium, you’ll also be responsible for any deductibles, copayments, and coinsurance.

Even with these factors, the average monthly Part D premium in 2026 is $34.50.

How to Get Medicare Part D

Medicare Part D offers prescription drug coverage to those enrolled in Medicare. There are two main ways to get this coverage. If you have Original Medicare (Parts A & B) and no other creditable drug coverage, you can enroll in a standalone Medicare Prescription Drug Plan (PDP). This PDP acts as a separate insurance plan specifically for your prescriptions.

Alternatively, if you’re already enrolled in a Medicare Advantage Plan (Part C) that doesn’t include drug coverage, you’ll likely be automatically enrolled in a Medicare Advantage Prescription Drug Plan (MAPD). This MAPD plan bundles your prescription drug coverage with your existing Medicare Advantage benefits, offering a simplified approach.

It’s important to note that not everyone needs a Medicare Part D plan. You may not need a drug plan if you already have creditable drug coverage through an employer or retiree plan. Evaluate your existing coverage to avoid paying a lifelong penalty on your Part D plan.

When to Sign Up for Medicare Part D

Medicare Part D plans are valid for an entire calendar year, allowing you to make changes during the Medicare Annual Enrollment Period, which runs from October 15 to December 7 each year. By selecting a new plan during this period, the new plan will become effective on January 1st of the following year, ensuring seamless transition and continued access to necessary medications.

Do I Need Medicare Part D if I Have Supplemental Insurance?

Having a Medicare Supplemental plan insurance typically doesn’t include drug coverage. Some carriers may offer limited prescription drug coverage but for most, you’ll want to consider enrolling in a separate Medicare drug plan.

Do I Need Medicare Part D if I Have an Advantage Plan?

Whether you need a Medicare Part D plan with your Medicare Advantage plan depends on whether your Advantage plan includes prescription drug coverage. Most Medicare Advantage plans bundle prescription drug coverage. These plans are called Medicare Advantage Prescription Drug Plans (MAPDs). If you’re enrolled in a MAPD, you likely have your drug needs covered and wouldn’t need a separate Part D plan.

If you’re part of the population of Medicare Advantage holders whose plan doesn’t include prescription drug benefits, enrolling in a separate Medicare Part D plan is recommended to help manage those costs.

TRICARE and Medicare Part D

If you’re a veteran receiving medications through the VA, are retired military personnel with TRICARE For Life, or are a retired civil servant covered under the Federal Employee Health Benefit Plan (FEHB), you likely don’t need a Medicare drug plan. Medicare considers TRICARE creditable coverage for prescription drugs so you don’t need a separate Part D plan.

TRICARE offers its own pharmacy benefits program, allowing you to fill your prescriptions at military pharmacies, through TRICARE’s home delivery service, or at network retail pharmacies. These benefits typically cover a wide range of medications, often comparable to what a Medicare Part D plan might offer.

However, there are a few exceptions. For example, if you specifically choose a TRICARE plan that excludes prescription drug coverage, or if you move to an area with limited TRICARE pharmacy access, then enrolling in a Medicare Part D plan might be necessary to ensure uninterrupted medication coverage. It’s always wise to check the specific details of your TRICARE plan and speak to a Medicare broker if you have any questions or concerns about your prescription drug coverage.

Find a Medicare Drug Plan with Medicare School

Avoid paying too much on your medications and find out if a Medicare Part D plan is right for you. At Medicare School, we work with several insurance carriers to help you find the right Medicare coverage that works within your budget. You can even learn more about Medicare from our blog, YouTube channel, and free virtual Medicare Workshop.

Let us take the confusion out of Medicare and schedule a consultation with a Medicare Guide or give us a call today.

Medicare Part D FAQs

What is Medicare Part D?

Medicare Part D is prescription drug coverage offered by private insurance companies approved by Medicare. It helps cover the cost of prescription medications.

Who is eligible for Medicare Part D?

Anyone enrolled in Medicare Part A and/or Part B is eligible for Part D coverage.

When can I enroll in Medicare Part D?

You can enroll during:

Initial Enrollment Period (IEP): When you first qualify for Medicare

Annual Enrollment Period (AEP): October 15 – December 7 each year

Special Enrollment Period (SEP): If you qualify due to specific life events

What happens if I don’t enroll when I’m first eligible?

You may have to pay a late enrollment penalty if you go without creditable prescription drug coverage for 63 or more days after becoming eligible.

How do I choose a Medicare Part D plan?

Compare plans based on:

Monthly premiums & deductibles

Drug formularies (covered medications)

Pharmacy networks & coverage restrictions