Do I Have to Sign Up For Medicare If I Have Employer Insurance?

Signing Up For Medicare With Employer Insurance

Welcome! In today’s post, we take on a commonly asked question; how do I sign up for Medicare if I have employer insurance?

Before we dive into this topic, we need to clarify a few things:

The employer insurance could be your plan or a plan offered through your spouse’s employer, either way, it doesn’t matter.

This advice applies to individuals who currently have employment and plan to keep working. However, it won’t apply if you plan to retire in the next two or three months.

Understanding Your Employer's Insurance Plan

With that out of the way, let’s address the first issue: How many employees work at your company?

Companies With 19 or Fewer Employees

According to Medicare guidelines, if your company has 19 employees or fewer, you are required to enroll in both Medicare Part A and Part B when you turn 65. This requirement is instituted because of how Medicare and small employer plans coordinate benefits. In this case, Medicare acts as the primary payer, and your company’s group plan is the secondary payer.

If you don’t sign up for Medicare at 65 and subsequently face a major health issue, your employer’s plan will still serve only as the secondary payer. If you don’t enroll in Medicare and put it in the primary payer position, then you take up the first payer role.

Most people facing this situation opt to drop their company plan and transition to a Medicare Supplemental Plan, a Medicare Advantage Plan, or one of many other Medicare options that usually offer better benefits. However, there is no choice but to enroll if your employer has 19 or fewer employees.

Companies With 20 or More Employees

If your employer has 20 or more employees, things are different, you aren’t required to do anything with Medicare. The primary options are:

Do Nothing: You’re under no obligation to enroll in Medicare Part A or Part B if you have employer insurance from a larger company.

Enroll in Medicare Part A Only: Medicare Part A is free for everyone who has at least 40 quarters (approx. 10 years) paid into the tax system. If you decide to take Medicare Part A while still covered under an employer’s plan, the employer’s insurance pays first, and Medicare pays second. Note, if you have a Health Savings Account and are still working, you may not want to take Medicare Part A, as it restricts further HSA contributions.

Enroll in both Medicare Part A and B: Some individuals compare the benefits of their employer’s insurance plan to the benefits of enrolling in Medicare and decide that it makes more financial sense to do the latter.

It’s crucial to consider the potential implications for your spouse or dependent children before making any drastic changes. If your dependents don’t have alternative insurance and rely on your employer’s plan, it may not be feasible to switch to Medicare.

Signing up for Medicare

To sign up for Medicare Part A or Part B, you’ll need to set up an account on the Social Security Government portal.

Go to the my Social Security account setup page.

Follow the prompts to create an account.

Save your login details securely.

With a MySSA account, you can enroll in Medicare online within a few minutes.

Over the years, we’ve gladly helped many individuals understand these details and make informed decisions about Medicare and employer-provided health insurance.

Enrolling in Medicare Elsewhere

If you retire or stop working at 67, you will be eligible to use a special enrollment period rather then the initial enrollment period, which only lasts for seven months surrounding your 65th birthday. If you want to go through a special enrollment, you will need to provide proof that you have had credible insurance through an active employer-provided plan, using an L564 form. This form will need to be filled out by your HR department.

You will also need to fill out a form 40B.

Choose the date you want your Medicare benefits to start.

In this scenario, no penalties or problems should occur. You can begin your Medicare coverage when your group insurance coverage ends.

This signup process is simple and easy to navigate. But always remember, Medicare signup processes can differ based on personal circumstances. Always check with your HR department or a Medicare expert if you have any doubts or questions.

What to Expect on Your Call With a Medicare School Guide

Enroll correctly which means you will avoid penalties.

Understand your coverage so you aren't surprised by any unexpected out-of pocket expenses.

Avoid selecting a plan with limited coverage which means you can be confident in your decision.

Save time with our simplified process so you can spend more time doing what you enjoy.

Receive unbiased advice from our independent guides that work for you, not an insurance company.

We are holding appointment slots for you, answer the question below to get started

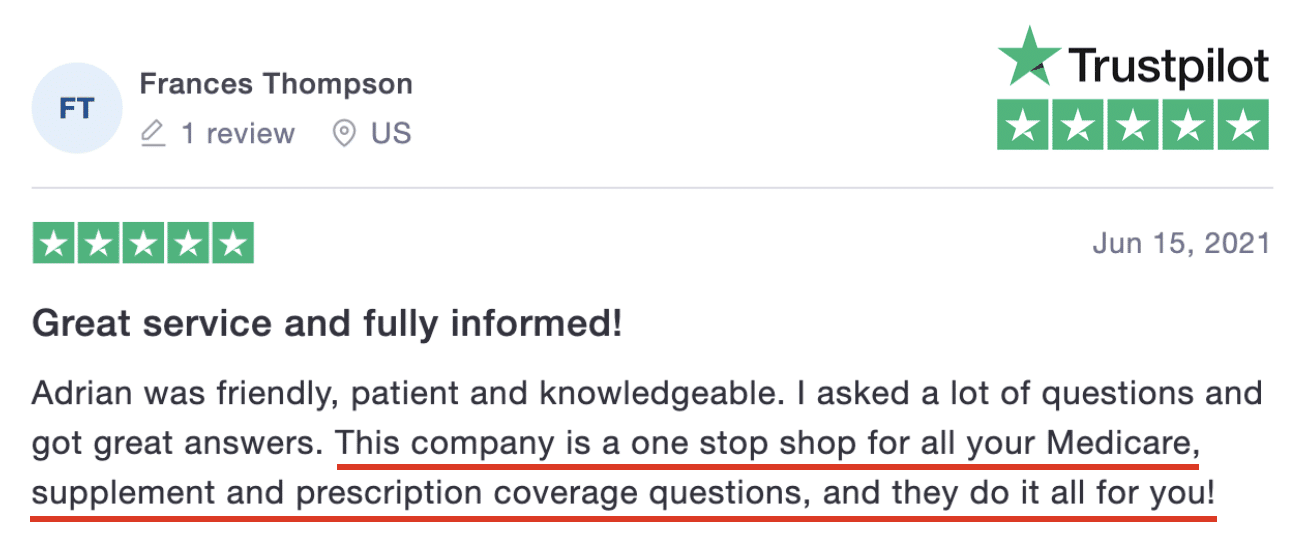

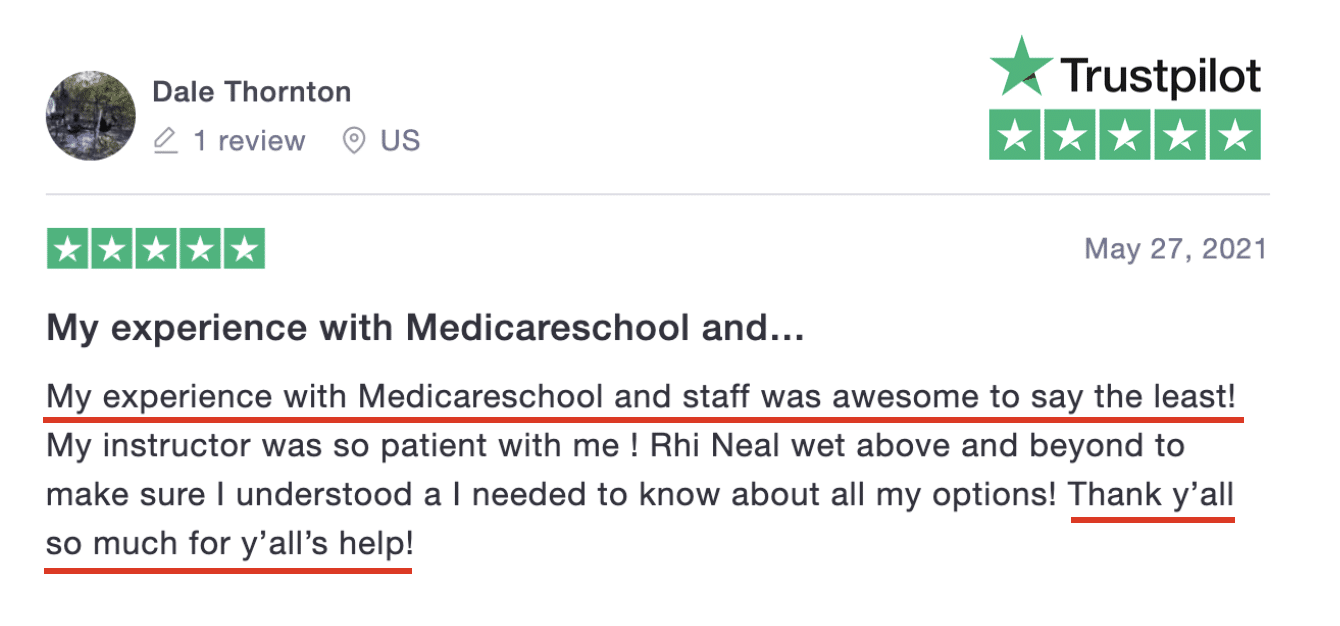

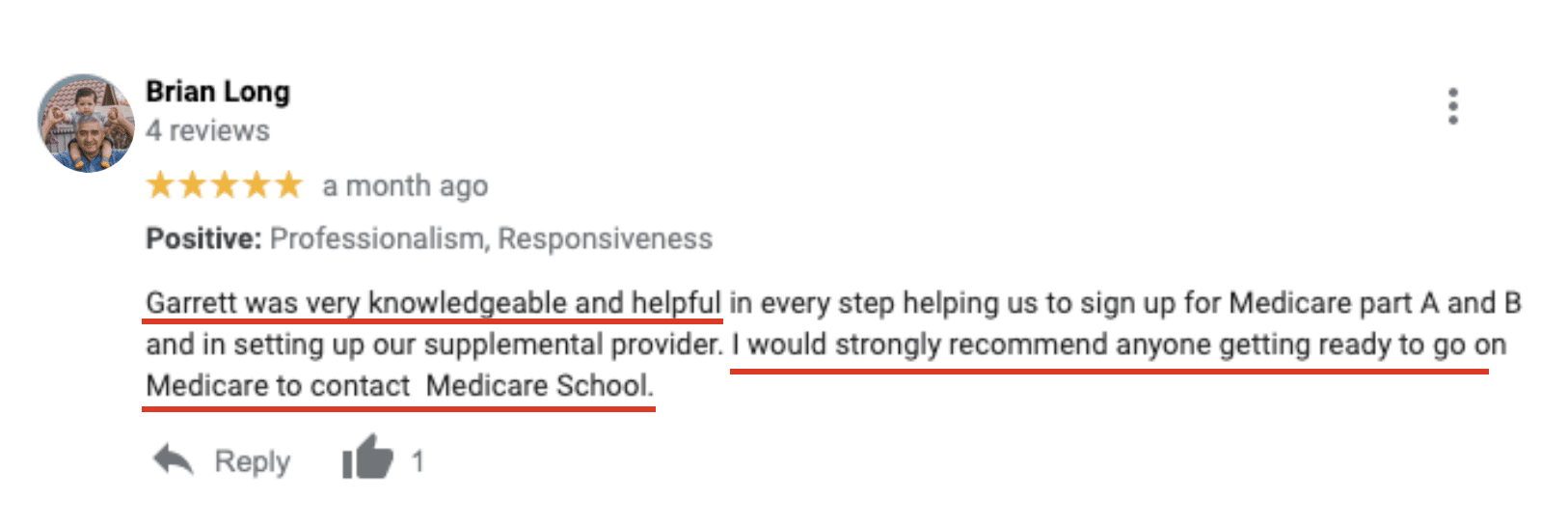

The Reviews are In!