When Should I Buy a Medigap Plan?

Understanding Medigap Plans: When and How To Buy

Join us for today’s discussion as we unravel the intricacies of selecting a Medigap policy and address the pressing question: When is the ideal time to purchase a Medigap plan? If you’ve opted to supplement your Medicare benefits with a Medigap policy, you might be scratching your head about when to make that move.

In pursuing this answer, we come across three essential terms that frequently pop up in the world of Medigap policies:

Open Enrollment

Guaranteed Issue

Underwriting

Let’s take a moment to understand these terms before we delve into ‘when’ to buy.

Open Enrollment, Guaranteed Issue, and Underwriting: Navigating Medigap Terminology

Open Enrollment is a term that applies in 46 out of the 50 states, and it sets the ground rules of when you can purchase a Medigap policy.

On the other hand, Guaranteed Issue implies that you can purchase a Medigap policy without having to go through underwriting and it applies continuously throughout the year. This rule applies in only four states: Connecticut, New York, Massachusetts, and Maine.

Lastly, Underwriting is a process that involves your health being examined before you can get insured. In 46 states, underwriting may be required when you’re trying to buy a Medigap policy outside of the specific open enrollment period.

Let’s understand these concepts further using an example.

Your 65th birthday marks your eligibility for Medicare. For instance, let’s say your birthday is on March 1, 1958, making you Medicare-eligible by March 1, 2023.

As described above, your enrollment in Medicare A and B (i.e., your A and B dates) will be the 1st of March, 2023. This initiates your Medigap Open Enrollment opportunity, which spans six months from your ‘B’ date (rather than your ‘A’ date), and during this period, no underwriting is required.

In other words, during your Open Enrollment period, insurance companies cannot question your health status. They are obligated, by law, to accept all of your preexisting conditions and will unequivocally approve your policy.

If you want to apply for a Medigap policy after your Open Enrollment period has ended—for example September 1, 2023 in this case, you will be required to go through Underwriting. During this process, you will undergo an in-depth examination of approximately 30 health-related questions, as well as a detailed inquiry about your medications and preexisting conditions. It’s important to understand that this thorough evaluation could potentially lead to the insurance company declining your application.

What If I Miss My Medigap Open Enrollment Period?

Assuming you miss the six-month Medigap Open Enrollment window, fear not, you can still apply for one. However, the process becomes a bit more demanding.

If your birthday is on March 1, 1958, but instead of retiring at 65, you choose to work two more years and retire at 67 with an ‘A’ date of March 1, 2023, and a ‘B’ date of March 1, 2025. Your six-month Medigap Open Enrollment period still commences from your ‘B’ date or March 1, 2025.

If you miss the opportunity to obtain a Medigap policy during this timeframe, beginning on September 1, 2025, you will be required to undergo the underwriting process in 46 out of the 50 states.

Therefore, it is crucial to remember that the best time to buy a Medigap policy is during your Medigap open enrollment period, as it precludes any underwriting.

In the remaining four states with guaranteed issues, underwriting isn’t a factor, but be prepared for potentially higher rates due to this provision.

Transitioning from Medicare Advantage to Medigap

Now, let’s say you decide against pursuing a Medigap policy when you first became eligible for Medicare, opting to get a Medicare Advantage Plan instead. Then, after several years on the Advantage plan, you decide to transition to a Medigap policy.

In this case, your open enrollment period would have ended, and for you to switch to a Medigap plan in the one of the aforementioned 46 states (excluding those with a guaranteed issue), you will have to go through underwriting. Outside of open enrollment, insurance companies are very unlikely to approve policies if they deem any health issues as problematic.

If you happen to have rheumatoid arthritis, diabetes with complications, spinal stenosis, any significant neurological disease, any cancer within the past 36 months, or a history of AFib, the insurance company will unfortunately reject your application.

Crucial Takeaways

The six-month Medigap open enrollment period eliminates medical underwriting. Companies are compelled to accept you, regardless of any preexisting conditions. It is crucial to take advantage of your Medigap policy during this period, particularly if you have any health worries. Stay tuned for more advice and tips on maximizing the benefits of your Medicare coverage.

What to Expect on Your Call With a Medicare School Guide

Enroll correctly which means you will avoid penalties.

Understand your coverage so you aren't surprised by any unexpected out-of pocket expenses.

Avoid selecting a plan with limited coverage which means you can be confident in your decision.

Save time with our simplified process so you can spend more time doing what you enjoy.

Receive unbiased advice from our independent guides that work for you, not an insurance company.

We are holding appointment slots for you, answer the question below to get started

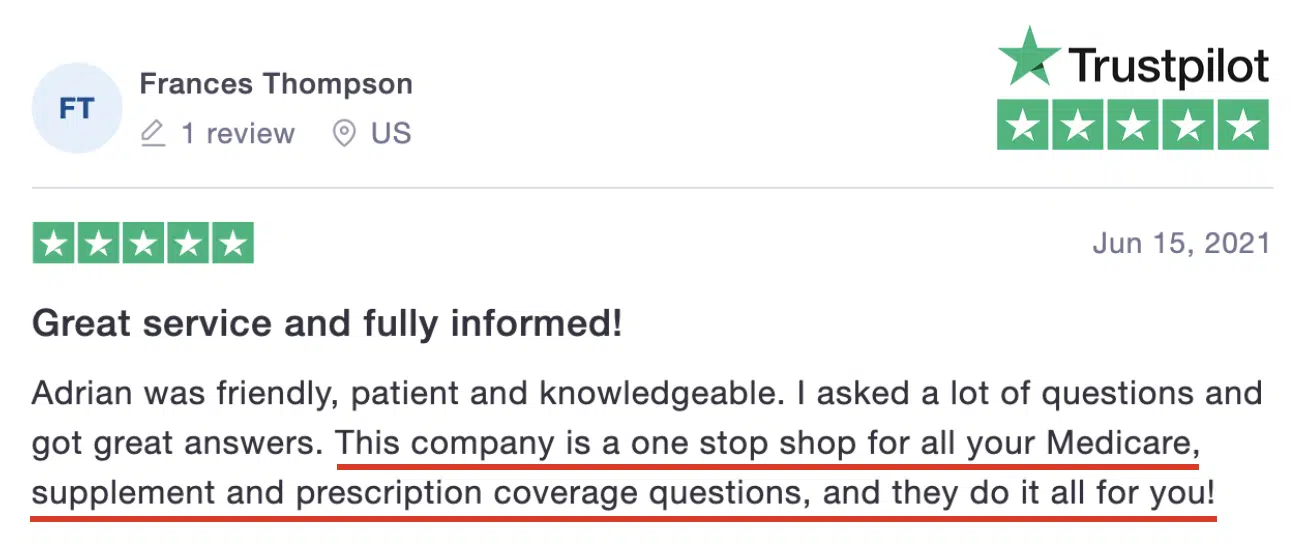

The Reviews are In!