What's The Difference Between Original Medicare And Medicare Advantage?

Comparing Medicare Plans: A Detailed Look at Original Medicare A, B and Medicare Advantage Part C

Today, we’re going to spill the beans on everything Medicare. If you’ve ever shrunk back from the overwhelming waves of information about Medicare, consider this your lifeboat. We’ll row together through the murky waters of Original Medicare A and B and the Medicare Advantage Part C. By the end of this trek, you will have mastered the differences between these plans and be more than equipped to make an informed decision about your healthcare options.

What is Original Medicare A and B?

Original Medicare comprises two parts – Medicare A, generally free for most people and covers inpatient care, and Medicare B that carries a premium, typically around $164.90 for a single person earning below $97,000 annually or a couple earning less than $194,000 annually. There is a variety of scenarios in which you may end up paying more than the $164.90 a month, especially if you surpass the above-mentioned income limits. In these cases, you’ll also bear the financial burden of “gaps” in our coverage for every service other than preventive care.

These gaps are split into two categories: Part A, which covers inpatient hospital services, and Part B, which covers outpatient services, including doctor visits and other healthcare services outside the hospital setting. With Original Medicare, it’s essential to remember that Medicare only covers part of these services. The rest will either be out-of-pocket expenses or covered by a medigap policy – but we’ll delve into that later.

Understanding the Coverage Gaps of Original Medicare: Part A

Hospital Coverage

If you choose Original Medicare and end up in hospital, you’ll come up against a deductible – this year, it’s $1,600 for anywhere between one to sixty days in the hospital. This deductible isn’t annual – it can crop up multiple times within the year, which we will get to in a moment.

If you find yourself still in hospital past 60 days, daily copays kick in. For days 61-90, you’ll owe $400 a day, and after day 90, it skyrockets to $800 a day. An important takeaway here is that every day after 90 costs an extra $800.

Skilled Nursing Facility Coverage

For individuals who require inpatient rehabilitation following a stroke, hip replacement, or a similar injury, your expenses will be fully covered for the initial 20 days, provided that you have spent at least three days in the hospital. However, starting from day 21 up to day 100, there will be a daily charge of $200 that you will be required to pay.

Understanding the Coverage Gaps of Original Medicare: Part B

For outpatient services and doctor services, a deductible of $226 applies annually, followed by coinsurance. This coinsurance might sound somewhat refreshing, but it keeps going and going and going – Medicare pays 80% of your bill and leaves you to manage the remaining 20%. To add to the burden, there are what’s known as “excess charges” where you are responsible for an additional 15% of the bill if you visit a doctor who does not accept Medicare’s approved amounts as full payment.

While navigating through the potential financial burdens caused by the gaps in Original Medicare, one crucial advantage stands out: the freedom to choose any doctor who accepts Medicare. This flexibility empowers beneficiaries to seek care from their preferred healthcare providers anywhere in the country which accepts Medicare. However, despite this freedom, it’s essential to address the uncovered services that can lead to significant out-of-pocket costs. Fortunately, there are plans available to fill in these gaps and alleviate some of the financial responsibilities. But as you can see, the financial responsibility here is pretty substantial.

Medicare Advantage Part C

On the flip side, Medicare Advantage, also known as Part C presents a whole new perspective. It stands apart from Original Medicare in several ways, the most notable being that the actual coverage is managed by a private health insurance company that completely takes over the administration of Medicare services. This means that the plan operates independently and provides coverage through its own network of healthcare providers.

This plan still requires enrollment in Parts A and B, but the crucial added requirement is that you must live in the plan’s service area.

Under Part C, you have no gaps in coverage. When the plan replaces Original Medicare A and B, what you have instead are a bunch of copays. This can include a zero copay to see your primary care doctor and anywhere from $25 to $50 to see a specialist.

Hospitalization comes with daily copays (typically at $350 a day for a few days) instead of a deductible, and any procedures like MRIs or CAT scans may lead to additional copays.

Ultimately, it’s a pay-as-you-go system, and although it might sound fancier than Original Medicare, there are still financial responsibilities to bear.

On the plus side, Medicare Advantage plans often include prescription drug coverage, so you won’t need to add separate drug coverage. However, you still need to brace yourself for copays under this system.

The Bottom Line

When it comes to Medicare, the choices you make ultimately depend on your own preferences and individual circumstances.

Here’s a final comparison block to help you digest the information better:

Original Medicare A and B: No network restrictions, various deductibles and copays, you need to add additional drug coverage

Medicare Advantage Part C: Restricted to plan’s service area, various mandatory copays, includes drug coverage

Hopefully, you now have a clearer understanding of these Medicare options. Keep in mind that your well-being is on the line, so choose wisely for the best outcome!

What to Expect on Your Call With a Medicare School Guide

Enroll correctly which means you will avoid penalties.

Understand your coverage so you aren't surprised by any unexpected out-of pocket expenses.

Avoid selecting a plan with limited coverage which means you can be confident in your decision.

Save time with our simplified process so you can spend more time doing what you enjoy.

Receive unbiased advice from our independent guides that work for you, not an insurance company.

We are holding appointment slots for you, answer the question below to get started

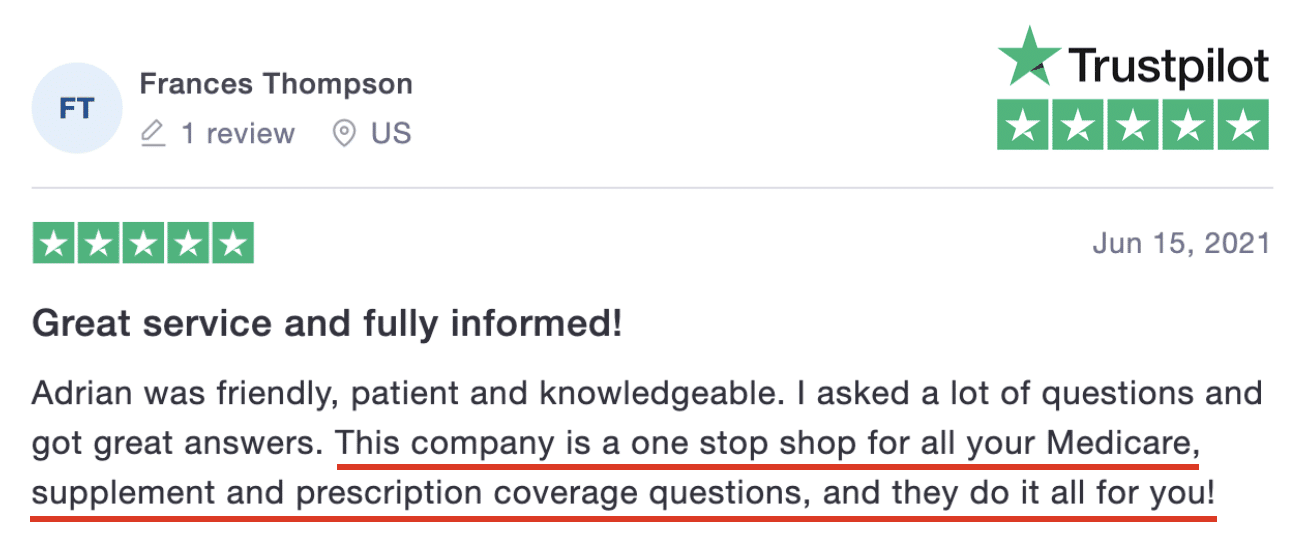

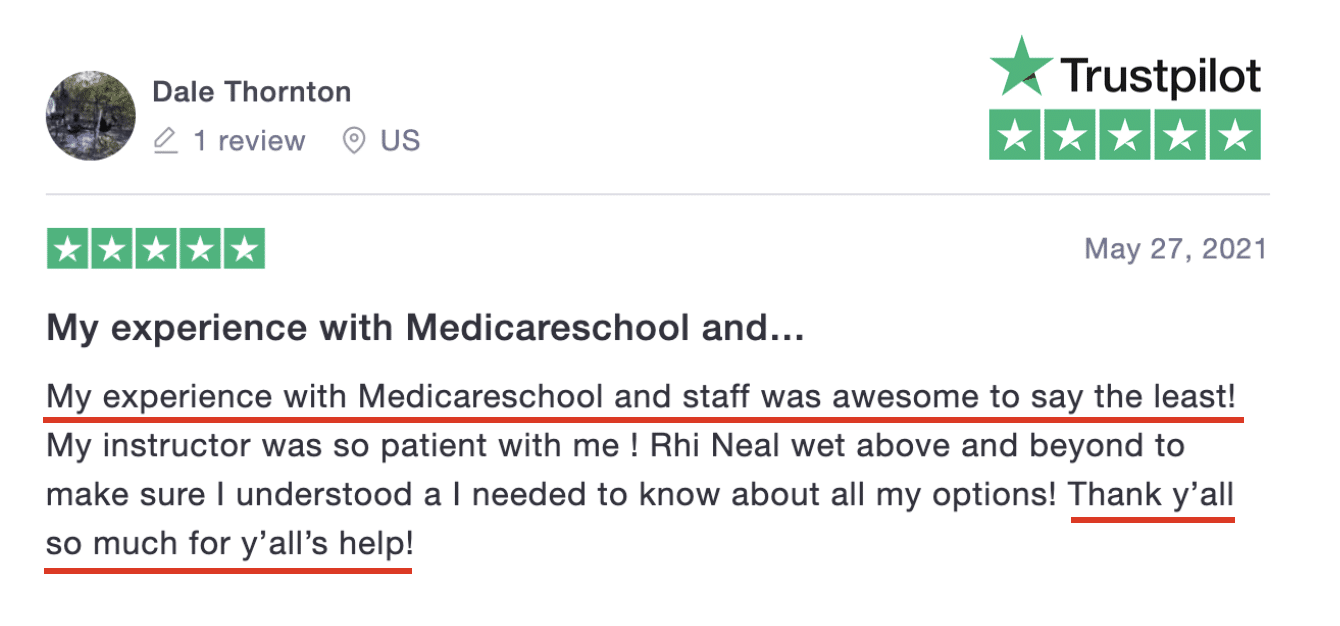

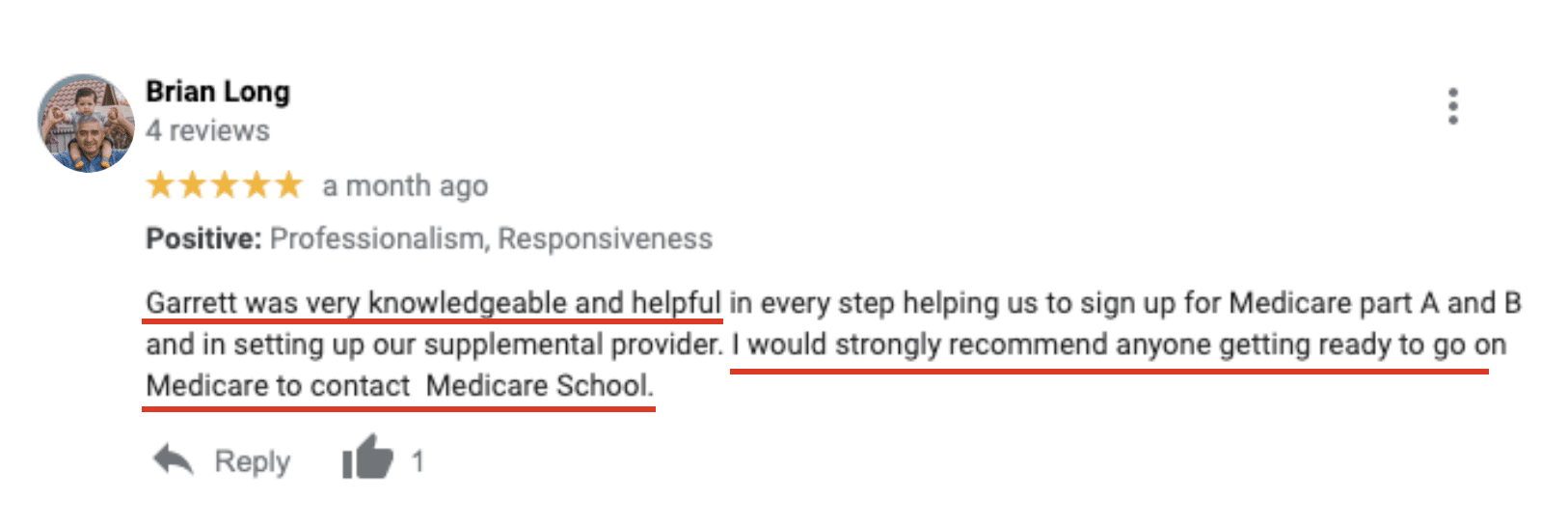

The Reviews are In!